Payment Card Industry Data Security Standard (PCI DSS) compliance

Secure credit card payment processing for contact centres

As taking payments can be a regular activity in a contact centre, MaxContact’s affordable self-service Payment IVR and Agent SafePay solutions are designed to enhance efficiency, ensure cardholder data security compliance and increase customer satisfaction.

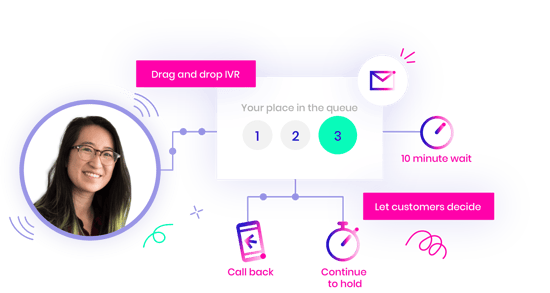

Call centre IVR solutions enabling intelligent self-service phone payments 24/7

MaxContact’s Interactive Voice Response (IVR) system for payments enables you to collect payments 24/7, 365 days a year. Securely hosted in Microsoft Azure, your bespoke Payment IVR will be available to collect payments at a time that works for the customer, without the need for agent interaction, to enable you to get paid quickly and easily.

How the IVR Automation Tool for Collecting Payments Works

-

Inbound call enters the IVR

-

The customer journey begins when they call your company and reach your IVR.

-

Identification and verification

-

The customer can be led through several security questions, with answers automatically cross-checked against data within either your MaxContact solution or an integrated third-party solution.

-

Check balance

-

After the customer has passed the ID ad verification stage, a check can be made on minimum payments required or account balances before the customer enters the amount they wish to pay.

-

Collecting card details

-

The customer will be requested to enter their credit card details for payment. These details will be captured via DTMF from their phone before being read back to the customer via text to speech.

-

Processing the payment

-

The collected card details will be encrypted and transferred to the payment merchant in real time.

-

Authorising the payment

-

Authorision will be confirmed within a matter of seconds. At this point authorisation codes will be sent to the customer and back office systems will be updated with the relevant information.

MaxContact Agent SafePay

MaxContact’s PCI-DSS Level 1 Compliant Solution will allow customers to enter their credit card details using their keypad, which protects all card data from agents and takes your call centre out of scope for compliance. When card information is being entered, the SafePay solution masks tones using DTMF and the card details are passed straight to the payment merchant, avoiding the need for agents to see the card details or to read them out at any point.

How the Agent SafePay Solution Works

-

Live phone call

-

At this point the customer is on the phone talking to the agent.

-

Start of Agent SafePay

-

When it comes to the point of the transaction, the agent will initiate Agent SafePay.

-

Entering of card details

-

The customer will be requested to enter their credit card details via the keypad on their phone. Notably, there is no need to pause the call recording at this point and the agent can guide the customer through the process.

-

Verification

-

The card details that have been entered are verified for payment by checking the basic information provided.

-

Making the payment

-

If the full card details have been entered the agent will be guided to ‘Make Payment’ for the transaction to complete.

-

Authorising the payment

-

Authorision will be confirmed within a matter of seconds. At this point authorisation codes will be sent to the customer and back office systems will be updated with the relevant information.

Contact us today!

Address

15/8 Fairfax Street, Sippy Downs,

Queensland, 4556.

Aus

1300 570 703

NZ

0800 197 020

Email

info@maxcontactaustralia.com.au

See how MaxContact can help

MaxContact’s ease of use has allowed us to quickly onboard new campaigns, and seamlessly run multiple campaigns at once for different clients.

Vilma Alvarenga

Contact Centre Manager, Chameleon Customer Contact

We were looking for a vendor that we could truly partner and scale with. Working with MaxContact has enabled us to do just that. We know if we have a question, or a new idea, then the MaxContact team will work with us to deliver.

Matthew Walton

Chief Sales & Marketing Director, Symmetry HR

We were able to set up the system on our own without having a dedicated IT person but we were also deeply impressed with the MaxContact technical team who took the time to understand our business and provide a solution scoped to match our business objectives.

Michael Mckeand

Founder Director, Health CX